The Christmas Gift: 22 December 2023

Three days to Christmas last year the Olayemi Cardoso-led Central Bank of Nigeria (CBN) lifted the over three-year ban on crypto transactions in Nigeria’s banking and financial system. Long overdue, the news was refreshing. It was a Christmas gift to many, locally and globally.

Finally, Nigeria would have an operative framework for the registration and licensing of the various categories of virtual assets service providers (VASPs). With such a framework set up, VASPs will have some reasonable level of clarity and certainty. There will be better collaboration and cooperation between regulators and VASPs. Gradually, the nightly clampdowns, crackdowns, and shutdowns that often make headlines in Nigeria’s crypto town will become a thing of the past. Registered and licensed in the country, VASPs will duly and fully become reporting entities, with obligations to operate with accountability, integrity, and transparency. Consumer protection and investor safety will become a shared responsibility. Trust and confidence will gradually improve, boosting local innovations, creating jobs, and attracting foreign direct investments (FDIs). The future of finance, enabled by regulation, will have a handshake with traditional finance, safeguarding the national economy and national security. Consumers will be the biggest winners. And Nigeria will thrive.

But if the most recent crypto clampdowns, crackdowns, and shutdowns in the country are anything to go by, it is not illogical or unreasonable to start thinking or feeling that the crypto ecosystem might have received a Trojan Horse last Christmas.

The Heartbreak that Came Nine Days to Valentine’s Day: 5 February 2021

5 February 2021 will not be forgotten in a hurry in Nigeria’s crypto history.

Unlike Governor Cardoso, the former CBN governor Godwin Emefiele does not do Christmas gifts. His was a letter that broke crypto’s heart. Perhaps even more heartbreaking to crypto, the letter was not delivered to crypto’s doorstep but circulated to all deposit money banks (DMBs), non-bank financial institutions (NBFIs), and other financial institutions (OFIs) in Nigeria. The message was simple: Close accounts of persons or entities involved in cryptocurrency transactions within your systems. In three words, stop dating crypto.

The reason for the outright crypto ban in the banking and financial system, as cited by the CBN, bordered on crypto-related cybercrime, money laundering, and terrorism financing. The CBN also raised investor safety concerns. Before shockingly ending this relationship by a circular, the CBN had earlier directed banks to date only KYCed crypto customers.

Consequently, no one was interested in dating crypto anymore. Crypto became demonized, discriminated against, and stigmatized. On some occasions, … criminalized. Coming just nine days before Valentine’s Day, crypto was heartbroken. In the next 6 months that followed this heartbreak, crypto ended up in therapy.

The emergence of P2P crypto trading in Nigeria and how the lack of crypto regulation fuels it.

After suffering heartbreak following the love letter, crypto adoption in Nigeria went peer to peer (P2P).

In a way, by driving crypto adoption in Nigeria underground, CBN had just granted one of Satoshi Nakamoto’s greatest wishes. Decentralization. P2P networks somewhat share this decentralized feature, enabling transactions one-on-one, peer-to-peer, without a third party. This is nearly where the Bitcoin inventor wanted crypto to be—running outside the traditional financial system without any intermediary, middleman, or third party.

With speed, Nigeria became the biggest P2P crypto market in the world. Nigeria also became Africa’s biggest crypto market. And the numbers continued to climb, without any operative regulatory framework for crypto in the country. With the emergence of P2P, centralized exchanges, depending on whether they integrated P2P infrastructure, had limited or inexistent roles to play here.

Binance, Luno, Quidax, and other centralized crypto exchanges, who are the crypto-to-fiat, fiat-to-crypto intermediaries, typically bridge the gap between the two worlds—traditional finance (TradFi) and decentralized finance (DeFi). Centralized crypto exchanges have built the rails that both the crypto and fiat worlds need to interact, exchanging or transferring anything of value, protected with cryptographic security yet purely transparent and traceable (except privacy coins and tokens). Centralized crypto exchanges have invested—and continue to invest—in know your customer (KYC) infrastructure and AML/CFT compliance. Centralized crypto exchanges, presently, are the most preferred access point to crypto globally. This is because, compared to decentralized crypto exchanges, they are more user-friendly. And should you lose your money to fraud or scams, centralized crypto exchanges have put procedures in place for possible asset recovery. This is possible because they typically collaborate with law enforcement agencies across various jurisdictions. Centralized crypto exchanges are the central gateway to and out of crypto town.

But centralized crypto exchanges cannot do it all alone. No one can. Like banks and other financial institutions, they also need legal and regulatory support. They can benefit greatly from frameworks that require corporate governance, cybersecurity, data protection, and other areas. Has the CBN, SEC, or other relevant regulator put these in place? Do centralized crypto exchanges have the level of clarity, certainty, and collaboration that is needed to ensure consumer protection and investor safety? Can a centralized crypto exchange obtain a license in Nigeria today? The answers are NO. But YES, we appear to have more than enough time in our hands to enforce crackdowns, clampdowns, and shutdowns in Nigeria’s crypto town. This is not regulation. Without proper regulation, fiat would have fallen flat on its face a long time ago. Crypto should not be treated differently. It’s only a new technology changing how we send, store, and secure value in a digital and smart economy.

With centralized crypto exchanges denied access to opening or operating bank accounts, P2P crypto transactions hit an all-time high in the Nigeria crypto industry. P2P continued to grow bigger and bigger in the financial system, largely underground, with octopus limbs. Gradually and surely, Nigeria eventually became the biggest P2P crypto market in the world, according to the 2023 Geography of Cryptocurrency Report by Chainalysis. This could not have been possible without the ‘helping hand’ of the CBN whose February 5 2021 circular ensured that centralized crypto exchanges—the major gateway and window to the cryptoverse—were denied the right to operate bank accounts, the most basic level of financial inclusion.

With respect, I continue to maintain that denying VASPs access to bank accounts effectively denies regulators and law enforcement agencies access to what would otherwise have been the most reliable platform for efficient and effective supervision, oversight, investigations, and enforcement.

As Adedeji Owonibi, Senior Partner at A&D Forensics and COO at Convexity, rightly told S&P Global Market Intelligence in a 2022 interview regarding the emergence of P2P crypto platforms in Nigeria, “There was an initial shock, but water will always find its path and the young people found P2P — the volume [of transfers] they were conducting through banks has been shifted [to P2P], so the banks no longer get those transactions’ fees”.

Moreover, relative to dealing with centralized crypto exchanges, P2P crypto platforms come with more risks, especially when conducted outside the P2P platform managed by a crypto exchange. Telegram, WhatsApp, and other instant-messaging platforms continue to serve as P2P platforms today. Therefore, the more regulators push the centralized crypto exchanges out, the wider the door to instant messaging-based P2P trading becomes. From an AML/CFT angle, this is more risky. Significantly more. As Marcus Swanepoel, Co-Founder and CEO of Luno, aptly captures this point following the CBN circular of 5 February 2021:

“Pushing people underground also makes it easier for scammers to exploit Nigerians, and we are already seeing Bitcoin trade at huge premiums in the country as a result of the ban. Other companies have made the choice to find workarounds that are less visible for regulators – for example, Peer-2-Peer (P2P) trading. Our view is that P2P trading would go against the spirit of the CBN’s directive. We believe that the focus should instead be on demonstrating to the CBN that exchanges such as Luno have the necessary controls in place to address the concerns it has in relation to cryptocurrencies.”

Like Swanepoel, many centralized crypto exchanges leaders expressed their willingness to collaborate with regulators, including the CBN. Many recommended that regulators should introduce the appropriate regulatory frameworks for VASPs. It’s now been over 3 years. Nigeria is still in the woods, clamping with clubs.

So when today P2P crypto platforms are projected to be the unwanted monster terrifying the Nigerian economy, Nigerian regulators must accept that their collective failings created this ‘monster’. Apparently. Putting it straight, Nigeria is not currently treating the real sickness in our crypto governance system. We are merely treating symptoms.

We have been here before.

How Nigeria lost the golden opportunity to become one of the most competitive and compliant crypto economies in the world

Particularly from 2017, Nigerians’ interest in bitcoin (BTC), ethereum (ETH), and other decentralized cryptocurrencies started growing significantly. Interestingly, the first circular by the CBN which effectively confirmed this trend was published in the new year of 2017. At this time, in the absence of crypto regulation, actors—both good and bad actors—launched crypto products and services. It was not too long when initial coin offerings (ICOs) were virtually everywhere on the Internet. From one single coin in 2008, the number of coins and tokens grew to tens of them, and then hundreds. Today, there are over 23,000 coins and tokens listed on Coinmarketcap.com. Meanwhile, the most popular cryptocurrencies in Nigeria have remained BTC, ETH, and Tether USD (USDT).

Apparently, after two CBN circulars (in January 2017 and February 2018) couldn’t keep crypto’s hot legs from going to town, crypto was eventually grounded. In February 2021, the CBN banned crypto from having any relationship with DMBs, OFIs, and NBFs.

But Nigerians still wanted a date with crypto.

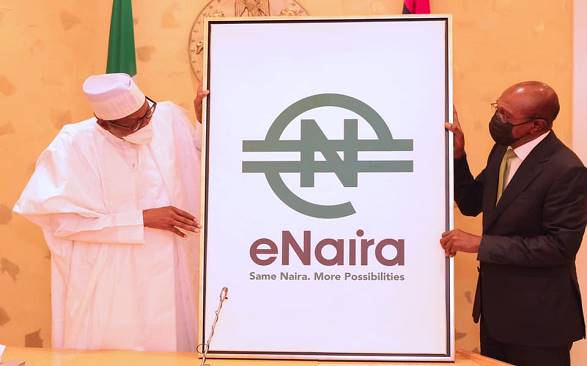

Against the background of rising inflation and increasing FX restrictions, Nigerians wanted crypto so bad—so bad that the CBN had to introduce eNaira. Although central bank digital currencies (CBDCs) also benefit from the same cryptographic security that decentralized cryptocurrencies like BTC and ETH enjoy, most Nigerians just could not get crypto out of their minds. Besides, unlike crypto, eNaira will not make Nigerians money. Not one kobo. And no Big Brother CBN or Big Brother Nigeria would have surveillance over their financial lives. That’s supposed to be private, right?

But as caring fathers would often do—particularly African fathers—the fatherly CBN always knows what is best for Nigerians. So eNaira is shoved down our throats (or our pockets or wallets this time). Reportedly, since October 2021, dating eNaira has been, for want of a better word, very boring.

To enable Nigeria achieve some level of transparency, efficiency, and integrity in the fast-growing crypto market in Nigeria, many stakeholders clamored for a risk-based crypto regulation. eNaira was not the appropriate response—and far less the answer—to the increasing rate of crypto adoption in the country. I have shared my thoughts on the eNaira in recent past and volunteered recommendations to help the CBN improve adoption. Meanwhile, in the present circumstances, I believe that CBN should focus on regulating innovations, including crypto, not building them, except of course such innovations are regulatory technology (RegTech). If eNaira is considered a form of RegTech, then the conversation has to change from enabling digital transactions to regulating them towards achieving more possibilities in a safer, more secure, and smart digital economy. With that, the CBN can then give control and ownership of the idea of eNaira to the financial intermediaries. Otherwise, eNaira is FinTech, effectively making the CBN a startup; an operator that also needs to be regulated. After all, in the world of emerging payment technologies, CBDCs are yet to be called into sainthood.

As I was saying earlier, stakeholders clamored for a risk-based crypto regulation, not ban. From the former Vice President of the Federal Republic of Nigeria, Prof. Yemi Osinbajo, to the former deputy governor of the CBN, Kingsley Moghalu; from the Blockchain Industry Coordinating Committee of Nigeria (BICCoN) to the Fintech Association of Nigeria (FinTechNGR), as well as the Stakeholders in Blockchain Technology Association of Nigeria (SiBAN), which I was privileged to serve as General Secretary and subsequently President at the time, the recommended approach was largely the same: an adaptive and risk-based regulation that will not stifle innovation in Nigeria’s nascent virtual assets sector.

No doubt, in my interactions and work with government agencies such as the Economic and Financial Crimes Commission (EFCC), the National Information Technology Development Agency (NITDA), and the Nigerian Financial Intelligence Unit (NFIU), these agencies understand the importance of regulating crypto in Nigeria. Commendably, one government agency, the Securities and Exchange Commission (SEC), introduced a regulatory framework for digital assets operators in Nigeria’s capital market. The SEC’s regulatory framework has remained inoperative apparently due to the stance of its more powerful sister-agency, the CBN. Though the SEC’s regulatory framework is not perfect (and currently under review), it is a good avenue for Nigeria to finally get out of the alley and hit the road. Sadly, we are still in the alley.

Recent developments in the crypto space in Nigeria may have forced government, regulators, and law enforcement agencies to (re)activate their reactionary approach to the impact of crypto in the country’s financial system. Understandably, having lost the golden opportunity to regulate crypto adaptively and proactively when the window of opportunity was wide open for years, the Nigerian government and regulators cannot be questioned—at least logically—for now taking the bull by the horn through crackdowns, clampdowns, and shutdowns in Nigeria’s crypto ecosystem.

Meanwhile, South Africa, ranked 2nd in crypto adoption after Nigeria, according to a recent Chainalysis report, is showing that it understands crypto to be a financial technology (FinTech) for providing or improving financial services. And like other financial services, this requires regulation in order to ensure consumer protection and investor safety. Also, Kenya, ranked 3rd in crypto Africa, is considering a VASPs bill after Kenya’s parliament requested the development of a draft crypto bill from the industry.

The International Monetary Fund and Nigeria’s Approach to Crypto Adoption

Recently, the International Monetary Fund (IMF) commended Nigeria’s recent regulatory actions on crypto. I will highlight the IMF’s stance and try to show that although Nigeria has been taking gradual steps I believe are welcome developments, the country has left a serious vacuum in crypto regulation that remains unfilled.

First, the IMF welcomes the requirement that AML/CFT policies must be implemented by crypto trading platforms and other VASPs in Nigeria in order to prevent or minimize illicit transactions. Since the CBN issued its first-ever circular on crypto adoption in January 2017, it was not until 2022 that Nigeria introduced a new Money Laundering Act and Terrorism Act that recognized virtual assets and then VASPs as “financial institutions”. This effectively made VASPs subject to supervision and reporting for the purpose of AML/CFT compliance. But were the AML/CFT laws implemented by regulators and other relevant agencies as contemplated by lawmakers?

If the fact that the government allowed the CBN circular of February 2021 to be enforced in the country for nearly 3 years is anything to go by, Nigeria failed to implement its own written laws. Nigeria allowed the ghost of Godwin Emefiele’s crypto regime to reign supreme above the Nigerian Constitution; above all laws of the National Assembly; and above all regulations, including the regulatory framework introduced by the SEC in May 2022 for crypto regulation in the capital market. Emefiele’s circular-made law should not have been allowed to effectively override the written laws of the land, such as the Money Laundering Act and the Terrorism Act, for example. Seeing the damage this might do to the country in the long run, some stakeholders, including me, had questioned the circular. In October 2021, the Federal High Court agreed that the circular is questionable, having no place under Nigerian law.

I acknowledge that the CBN took an important step under its new leadership, Governor Olayemi Cardoso. This is commendable. But I believe that the CBN is yet to take the all-important first steps—recognizing crypto as a FinTech, demonstrating that the CBN is a regulator that fully understands and appreciates that the future of finance is evolving, and signaling that it is well-positioned to navigate the inevitable transition in finance by finding the much-needed balance between regulation and innovation. This requires regulatory vision, regulatory intelligence, and collaborative regulation. Perhaps more importantly, it also requires a good dose of courageous humility, a virtue one often find lacking in our regulatory domain. Courageous humility builds credibility incredibly. Yes. Courageus humility builds bridges, not fences. On the one hand, just as a Master washed his servant’s feet as recorded in John 3:6–10, regulators must learn to be courageously humble enough to wash crypto’s (unclean) feet. On the other hand, if regulators consider crypto too unclean to dwell in today’s financial system, at least she could be permitted to wash the regulators’ feet (Luke 7: 37–47). Faced with two extremes, we must be intentional about finding a middle ground. Extremes push us to the fringes. Sooner or later, the hinges may not be able to hold any longer. Clampdowns, crackdowns, and shutdowns, in the long run, will only end up keeping us down, down, down. Resistance to change isn’t regulation. My thoughts on how Nigeria got this wrong with the CBN crypto ban and how we can get it right are fully documented here.

Even today, warnings are flying all over the place in Nigeria’s financial services industry over the onboarding of crypto customers. Why have we readopted the all-too-familiar blanket restriction of crypto in the banking and financial sector when we should be allowing DMBs, OFIs, and NBFs to determine the risks of entering relationships with VASPs on a case-by-case basis? Why are we banning P2P crypto platforms when we should be requiring proper registration and compliance? I see “P2P” being demonized, same way “crypto” was demonized (and still is to some reasonable extent today). “P2P” is a people-driven, people-based financial services model. Even CBN’s eNaira integrates P2P payments using Near Field Communication (NFC). Under my leadership, SiBAN’s first-ever conference in 2022 was “P2P”. “P2P” is the future of transactions. It requires regulation, not ban.

Interestingly, as directed in January 2017, the CBN actually required banks and other financial institutions to implement AML/CFT on VASPs in order to avoid or minimize illicit transactions through the use of cryptocurrencies in Nigeria. This was the right call. But in February 2021, CBN effectively—and rather arbitrarily—abandoned AML/CFT compliance policy for crypto-related customers or VASPs. In other words, the CBN preferred enforcing a ban on crypto-related transactions in Nigeria’s banking and financial system to supervising AML/CFT compliance.

With hindsight, considering the ever-growing interest in crypto amongst millions of Nigerians, as one would imagine, CBN only succeeded in pushing crypto adoption underground—a state where crypto transactions became even more vulnerable to illicit use. Supervision and reporting were significantly absent. Crypto-crime investigation was also largely impaired. There was absence of any semblance of crypto regulation in Nigeria.

Thankfully, in 2022, Nigeria eventually amended the Money Laundering Act and Terrorism Act and the Terrorism Act. But as earlier observed, Nigeria appears to be observing its own AML/CFT laws and regulations in breach.

How?

DMBs, OFIs, and NBFs, till date, have continued to rely on CBN directives on crypto restrictions in the banking and financial sector, not the provisions of the written laws of the National Assembly. Effectively, as far as crypto-related transactions and bank-account operations are concerned in Nigeria, we might as well be back to February 2021.

In December 2023, the now Governor Olayemi Cardoso-led CBN introduced guidelines for the operation of bank accounts by VASPs in Nigeria, effectively lifting the crypto ban (or so it was thought by many followers). Amongst other requirements, the Guidelines reintroduced AML/CFT compliance and reporting on the part of banks and other financial institutions that create a customer relationship with VASPs.

But the Guidelines remain inoperative because the CBN requires that before a VASP can have a bank account in Nigeria it must have a SEC license. At the time of writing, SEC is yet to introduce a regulatory framework for registration and licensing of VASPs. Whereas, VASPs continue to face clampdowns, crackdowns, and shutdowns since February 2021. Gradually, the idea of obtaining a VASPs license in Nigeria has degenerated—for want of a better word—from being a mission to an illusion. It is in a state of limbo.

Second, the IMF acknowledges that while “bans can have a direct impact on the business of crypto exchanges”, “individuals are still likely to be able to trade and exchange crypto assets by alternative means.” This is contained in IMF’s Global Financial Stability Report: Covid-19, Crypto, and Climate: Navigating Challenging Transitions, October 2021. Considering the challenge above, the IMF recommends that “jurisdictions should actively coordinate with the relevant authorities and international standard-setting bodies to maximize the effectiveness of their enforcement actions and minimize regulatory arbitrage.” However, this requires considerable resources, which is “a greater challenge for emerging market[s] and developing economies.” Nigeria, for example. We do not have adequate resources to enforce crypto bans or blanket restrictions. An adaptive and risk-based regulation will give Nigeria better results. Here, collaboration is key. Regulators, including the CBN, must unlearn the already tested but tired approach of trying to regulate crypto in Nigeria by issuing circulars and guidelines to banks and other financial institutions without bringing the crypto operators themselves into the room. Industry collaboration is critical. Collaboration and multi-stakeholder engagements are not the kind of calls one should expect security and law enforcement agencies to typically pick. Crackdowns, clampdowns, and shutdowns without clarity and certainty in the regulatory environment can make big headlines, no doubt. But these actions cannot—and will not—help Nigeria achieve a sound, safe, and sustainable financial system. A sound, safe, and sustainable financial system is built on trust and confidence, not power, and certainly not force.

Third, as one of its chief recommendations, IMF emphasizes that policymakers “need to balance enabling financial innovation and reinforcing competition and the commitment to open, free, and contestable markets, on one hand, against challenges to financial integrity, consumer protection, and financial stability.” Has Nigeria succeeded in striking that much-needed balance? Far from it. And this is an understatement. With responsible innovation and responsive regulation, the Nigerian crypto ecosystem should easily be one of the most globally competitive and compliant business environments for VASPs today.

The Earthquake that an alternative economy powered by crypto may bring to the traditional financial system, if regulation is not inclusive.

What Nigeria does not want to do is watch crypto become an alternative economy, all because we continue to push it underground. Earthquakes always start underground—the hypocenter. The location directly above earth surface is the epicenter. Traditional financial system is at the epicenter today. Should crypto become an alternative economy, it may erupt at the hypocenter. Earthquake.

We cannot afford a financial system earthquake, because we failed to listen; or because it was too difficult for us to imagine a convergence between the old and the new—an evolutionary convergence that requires striking balances, not swooping clubs. Nigeria needs regulation—an adaptive, inclusive, neutral, and risk-based regulation. The CBN or other regulators trying to shave crypto’s head in its absence cannot be regulation. Regulation involves governance of market participants.

According to Grandview Research, the global blockchain technology market size was valued at USD 17.46 billion in 2023. From 2023 to 2030, this is expected to grow at a compound annual growth rate (CAGR) of 87.7%. Crypto is a big part of the blockchain economy. And crypto adoption continues to surge in the country, requiring a regulatory shift—the kind that considers the Nigerian context and balances innovation with regulation.

In today’s increasingly decentralizing, data-driven global economy, any crypto regulation that does not have centralized crypto exchanges registered and licensed as vital players in the financial system cannot be regulation.

Rather than groping in the darkness we brought upon ourselves because we failed to adopt a clear, certain, and collaborative regulatory approach to crypto adoption in the country, we need to take intentional steps to enable us understand our unique socio-cultural, socio-economic, and socio-political context and then adapt existing law and regulations accordingly. No IMF or World Bank will teach us how to understand these local dimensions. It is imperative that we consider our own context.

We need crypto regulation. For years, the Nigeria crypto industry has—with the limited support given to it by governments and regulators—been largely self-regulating. We cannot continue to hawk common inaccuracies and misconceptions about how all or most of crypto is anonymous, criminal, dark, and opaque. Not in 2024. These often misinformed narratives about crypto only further demonize, discriminate, stigmatize, and victimize crypto. Yesterday, bureau de change (BDC) operators were the problem. And then crypto exchanges operating bank accounts became the problem. Today, P2P platforms are the problem. Tomorrow, in the current state of lack of registration, licensing, and supervisory framework for crypto operators or VASPs in Nigeria, what or who will be blamed next? Well, today, I think it all comes back to the absence of an operational risk-based regulation in the various subsectors of the Nigerian crypto ecosystem. Today, no single government agency or regulator in Nigeria has an operative licensing system for VASPs. None. Even the Corporate Affairs Commission (CAC), where the life of any business legally starts, will query applications from VASPs, whether you play in crypto or blockchain technology.

With Nigeria’s potential, considering its huge youth population, mobile penetration, and growing startup ecosystem, the Tigran Gambaryans of this world are not—and cannot possibly be—Nigeria’s headache. Our crypto regulatory system is not in good condition. It is presently unhealthy. This unhealthy condition is what the Nigerian government and regulators need to treat. And urgently too. Treating the present condition requires the government, the regulators, and the innovators to have an open conversation about the future of finance and the role that each of us must play to ensure consumer protection, investor safety, and financial stability. The Tigran Gambaryans of this world should be happily supporting regulatory intelligence in a roundtable or boardroom, not battling with Malaria in prison. This benefits no one. We have a billion-dollar industry to regulate, and more importantly, a future to secure for over 220 million people. Nigeria has all it takes to get this right. A place to start is getting to have the right conversations about the future of finance and the role each of us must play towards ensuring a sound, safe, and sustainable financial system. Free Tigran Gambaryan.

Responsible regulation is what Nigeria needs.

Senator Ihenyen is the Lead Partner at Infusion Lawyers where he heads the Blockchain & Virtual Asset Practice. He is the immediate former President of SiBAN and former General Secretary of Blockchain Industry Coordinating Committee of Nigeria (BICCoN) and Fintech Alliance Coordinating Team (FACT). Senator is the Founding Editor of CAB and Advisory Board member, Lagos Blockchain Week.

Endnotes

- “Finally, ‘crypto ban’ in Nigeria lifted by the CBN”, Crypto Asset Buyer (CAB), December 22, 2023, https://cryptoassetbuyer.com/crypto-ban-in-nigeria-lifted-by-the-cbn/

- ‘Experts comment on Nigeria’s Binance crackdown, said it shook investor’s confidence ’, Nairametrics, March 2024, https://nairametrics.com/2024/04/16/experts-comment-on-nigerias-binance-crackdown-said-it-shook-investors-confidence/

- ‘Nigeria’s Cryptocurrency Crackdown Will Have Consequences, Experts Say’, VOA News, 11 March 2024, https://www.voanews.com/a/nigeria-s-cryptocurrency-crackdown-will-have-consequences-experts-say/7523302.html

- ‘Nigeria blocks access to crypto exchanges in effort to curb currency slide’, Financial Times, 22 February 2024, https://www.ft.com/content/333309a5-196c-494a-8d68-506f6a19ba81

- ‘Letter to All Deposit Money Banks, Non-Bank Financial Institutions and Other Financial Institutions’, the Central Bank of Nigeria (CBN), 5 February 2021, https://www.cbn.gov.ng/out/2021/ccd/letter%2520on%2520crypto.pdf&ved=2ahUKEwiWu67Mz73_AhVNQ0EAHeKXD1UQFnoECAsQAQ&usg=AOvVaw0HlW_f2TFe07tIZ0Lo69vx

- ‘Response to Regulatory Directive on Cryptocurrencies’, the Central Bank of Nigeria (CBN), 7 February 2021, https://www.cbn.gov.ng/out/2021/ccd/cbn%2520press%2520release%2520crypto%252007022021.pdf&ved=2ahUKEwjmuMXdns6GAxVt_7sIHXCMBG8QFnoECBAQAQ&usg=AOvVaw2uuK3vBdQI8iIulabSW-Qm

- ‘Why Nigeria has the highest P2P crypto transactions in the world’, Techpoint, 1 November 2023, https://techpoint.africa/2023/11/01/p2p-crypto-volumes-in-nigeria/

- ‘Cryptocurrency Penetrates Key Markets in Sub-Saharan Africa as an Inflation Mitigation and Trading Vehicle’, Chsinalysis, 19 September 2023, https://www.chainalysis.com/blog/africa-cryptocurrency-adoption/

- ‘Centralized vs Decentralized Exchanges’, Coinmarketcap, 2022, https://coinmarketcap.com/academy/article/centralized-vs-decentralized-exchanges

- ‘The 2023 Global Crypto Adoption Index: Central & Southern Asia Are Leading the Way in Grassroots Crypto Adoption’, Chsinalysis, 12 September 2024, https://www.chainalysis.com/blog/2023-global-crypto-adoption-index/

- ‘Cryptocurrency usage soars in Nigeria despite bank ban’, S&P Global Market Intelligence, 9 June 2022, https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/cryptocurrency-usage-soars-in-nigeria-despite-bank-ban-70497781

- ‘Luno’s view on the regulation of cryptocurrency’, Marcus Swanepoel, Luno, 2 March 2021, https://discover.luno.com/lunos-view-on-regulation/

- ‘’98.5% of wallets unused’ — IMF says eNaira adoption disappointingly low’, The Cable, 22 May 2023, https://www.thecable.ng/98-5-of-wallets-unused-imf-says-enaira-adoption-disappointingly-low/amp/

- ‘Bridging Gaps in eNaira Adoption in Nigeria’, Senator Ihenyen, Infusion Lawyers, 11 July 2023, https://infusionlawyers.com/bridging-gaps-in-enaira-adoption-in-nigeria/

- ‘Osinbajo opposes cryptocurrency ban’, Premium Times, 26 February 2021, https://www.premiumtimesng.com/news/headlines/445539-osinbajo-opposes-cryptocurrency-ban.html?tztc=1

- ‘Moghalu Urges CBN to Reconsider Ban on Cryptocurrency Transactions’, ThisDay, 2021, https://www.thisdaylive.com/index.php/2021/02/08/moghalu-urges-cbn-to-reconsider-ban-on-cryptocurrency-transactions/

- ‘BICCoN hits back at CBN’s crusade against Crypto’, Nairametrics, February 2021, https://www.google.com/amp/s/nairametrics.com/2021/11/23/biccon-hits-back-at-cbns-crusade-against-crypto/%3famp=1

- ‘The Cryptocurrency Issue in Nigeria; Finding the Middle Ground’, Fintech Association of Nigeria, https://fintechng.org/the-cryptocurrency-issue-in-nigeria/

- ‘Why FG should revisit cryptocurrency ban, by Blockchain association’, The Vanguard, 11 March 2021, https://www.vanguardngr.com/2021/03/why-fg-should-revisit-cryptocurrency-ban-by-blockchain-association/

- Rules on Issuance Offering and Custody of Digital Assets, the Securities and Exchange Commission (SEC), 22 May 2022, https://sec.gov.ng/wp-content/uploads/2022/05/Rules-on-Issuance-Offering-and-Custody-of-Digital-Assets.pdf&ved=2ahUKEwikw6TBpM6GAxVShP0HHS6iBtQQFnoECB8QAQ&usg=AOvVaw3aGsVeV5BttJd5dJ_etTh5

- ‘Cryptocurrency Penetrates Key Markets in Sub-Saharan Africa as an Inflation Mitigation and Trading Vehicle’, Chainalysis, 19 September 2023, https://www.chainalysis.com/blog/africa-cryptocurrency-adoption/

- ‘Kenyan lobby group takes the country’s first-ever crypto bill to parliament’, Techpoint, 7 February 2024, https://techpoint.africa/2024/02/07/blockchain-group-drafts-kenya-crypto-bill/

- ‘Crypto Adoption in Nigeria: IMF commends regulatory actions.’, Crypto Asset Buyer (CAB), 8 June 2024, https://cryptoassetbuyer.com/crypto-adoption-nigeria-imf/

- ‘IMF Now Recommends for Crypto Regulation in Nigeria Similar to Financial Intermediaries’, BitKe, 13 May 2024, https://bitcoinke.io/2024/05/imf-now-recommends-for-crypto-regulation-in-nigeria/

- Suit No. FHC/ABJ/CS/822/2021. Delivered by the Federal High Court (Abuja Division) by Honorable Justice Taiwo O. Taiwo, 18 October 2021

- ‘Has the “cryptocurrency ban” in Nigeria been lifted?’, Senator Ihenyen, Infusion Lawyers, 30 June 2023, https://infusionlawyers.com/has-the-cryptocurrency-ban-in-nigeria-been-lifted/

- ‘Opay, PalmPay, others warn customers against crypto trading’, The Punch, 3 May 2024, https://www.google.com/amp/s/punchng.com/opay-palmpay-others-warn-customers-against-crypto-trading/%3famp

- ‘SiBAN Holds Maiden P2P Conference on August 6’, ThisDay, August 2022, https://www.thisdaylive.com/index.php/2022/08/05/siban-holds-maiden-p2p-conference-on-august-6/

- ‘Circular to Banks and Other Financial Institutions on Virtual Currency Operations in Nigeria’, CBN, 12 January 2017, https://www.cbn.gov.ng/out/2017/fprd/aml%20january%202017%20circular%20to%20fis%20on%20virtual%20currency.pdf

- Global Financial Stability Report: Covid-19, Crypto, and Climate: Navigating Challenging Transitions, the International Monetary Fund (IMF), October 2021, https://www.imf.org/en/Publications/GFSR/Issues/2021/10/12/global-financial-stability-report-october-2021&ved=2ahUKEwjX5_Hjk86GAxW1h_0HHUAWBa0QFnoECBIQAQ&usg=AOvVaw1G-O6EpCPoS4bhcLfG_2OS

- ‘Regulation’: Britannica, https://www.britannica.com/topic/regulation

- ‘Blockchain Technology Market Size & Outlook’, Grandview Research, https://www.grandviewresearch.com/horizon/outlook/blockchain-technology-market-size/global

- ‘Crypto in Nigeria – Surge in Adoption and Regulatory Shifts’, Lizard Mills, Crypto Council for Innovation, 9 February 2024, https://cryptoforinnovation.org/crypto-in-nigeria-surge-in-adoption-and-regulatory-shifts/

- ‘McCaul, McCormick, Colleagues Urge the State Department to Intervene in the Wrongful Detention of Tigran Gambaryan’, United States Foreign Affairs Committee, 5 June 2024, https://foreignaffairs.house.gov/press-release/mccaul-mccormick-colleagues-urge-the-state-department-to-intervene-in-the-wrongful-detention-of-tigran-gambaryan/

Discover more from Crypto Asset Buyer

Subscribe to get the latest posts sent to your email.