by Convexity

You would have encountered articles and friends discussing the pending Bitcoin halving and how it is poised to rocket everything to the moon. It’s safe to say, ‘Bitcoin is having a moment’ after the long winter to return to its all-time-high – ATM. Suppose you’re not familiar with the context of why Bitcoin halving occurs. In that case, you might get flustered and feelings of fear of missing out – FOMO – will likely cloud your judgement especially if you are a tourist to the digital asset world. So what is the Bitcoin Halving cycle and why it matters to you, is distilled in this article by Convexity. It covers:

- What is Bitcoin and Bitcoin Halving

- History of Bitcoin Halving

- Economic Implication to Miners

- Impact on Investors and the Global Economy

What is Bitcoin?

One of the most confusing concepts for those new to bitcoin is understanding that the word “bitcoin” can refer to two related, but distinctly different things. There is Bitcoin the network or payment system, and then there is bitcoin the token or asset. To help avoid confusion, we will adopt the standard of capitalizing Bitcoin when referring to the network and using a lowercase character for bitcoin the token or asset.

“Bitcoin” the Network vs. “bitcoin” the Asset

bitcoin is a virtual currency designed to act as money, a neutral and trustless value transfer protocol for the world outside the control of any one person, group, or entity, thereby removing the need for any third-party involvement in financial transactions.

It was the first digital currency to solve two challenges associated with digital money: (1)controlling its creation and (2)avoiding its duplication.

bitcoin’s idea was laid out in a 2008 whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” and the Bitcoin network went live on 9th January 2010 and has gone on to shape the world’s monetary system. As a form of money, it possesses hard qualities of money that make it valuable such as limited supply, durability, fungibility, portable, and verifiable.

bitcoin runs on an open blockchain network that uses a proof-of-work consensus mechanism called ‘Bitcoin’. It is an open-sourced blockchain protocol for any enthusiast and developer to contribute to its various consensus code proposals and upgrades. The Bitcoin mining algorithm is designed to find a new block once every 10 minutes, averaging around 3,000 transactions/per 10 minutes and 144 blocks/24 hours. learn more

It is important to note that bitcoin has a fixed supply of 21 million coins. On why the team or individual known as ‘Satoshi Nakamoto’ chose this specific monetary design, little insights can be gotten from the letters written in the early days of Bitcoin development:

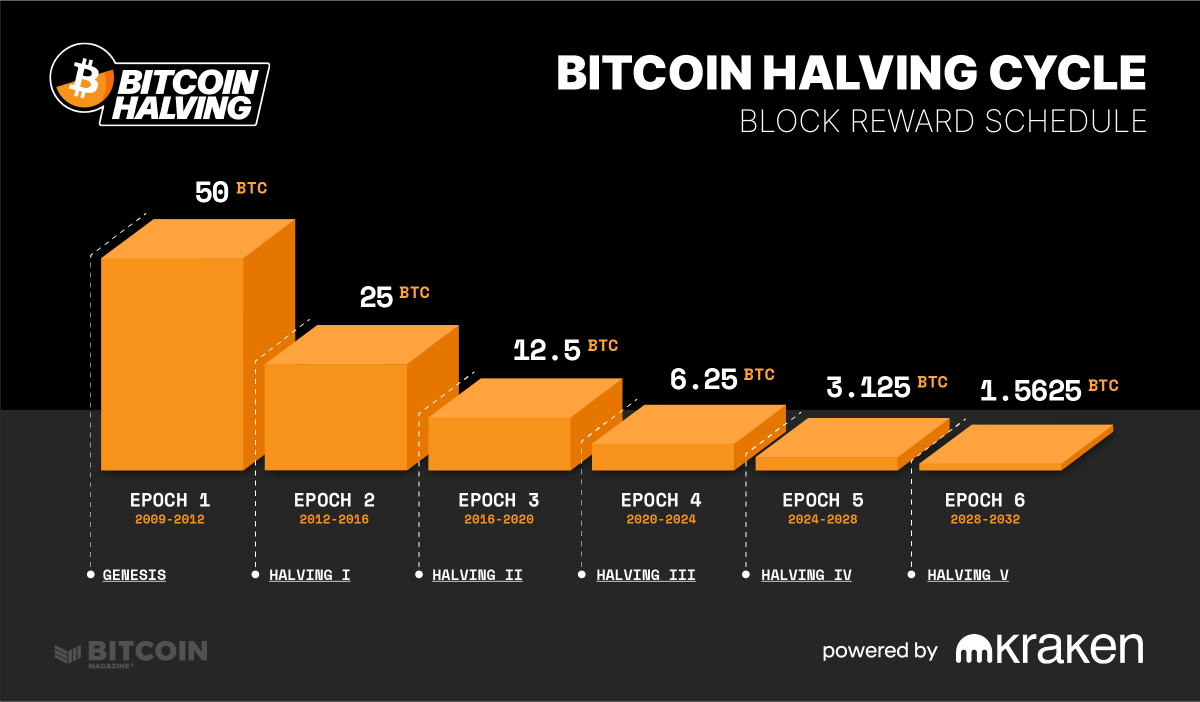

Total circulation will be 21,000,000 coins. It’ll be distributed to network nodes when they make blocks, with the amount cut in half every 4 years. first 4 years: 10,500,000 coins next 4 years: 5,250,000 coins next 4 years: 2,625,000 coins next 4 years: 1,312,500 coins etc… – Satoshi Nakamoto

What is Bitcoin Halving?

The Bitcoin Halving or ‘the halvening’ is the most celebrated event in Bitcoin’s history, it is a pre-programmed event in Bitcoin that disciplines the entire market for increased efficiency and reduces the reward given to crypto miners by half every 210,000 blocks or approximately every four years. This regular reduction in the bitcoin inflation rate is called the ‘halving’. Halving is essential because it ensures that the supply of bitcoin is kept in check and prevents inflation. The reduction of mining rewards means that the demand for bitcoin is expected to increase, and its value is likely to surge in response. Bitcoin Halving plays a crucial role in the long-term viability and scarcity of Bitcoin.

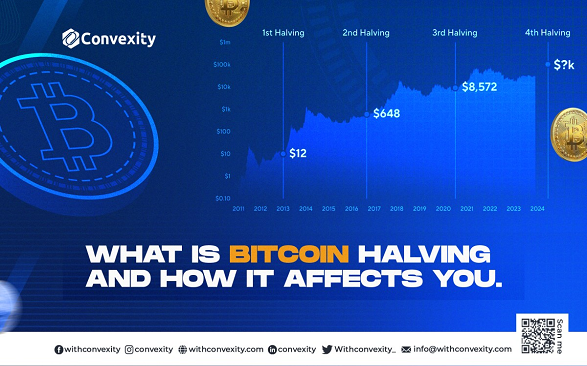

Bitcoin Halving History

The past is a landmark for how much progress has been achieved and a lighthouse for the progress unattained. Halving is a game theory that secures Bitcoin and ensures that a) miners have an incentive to mine honest blocks [and] b) miners have a cost to attempting dishonesty according to Dubrovsky. Let’s go down history avenue:

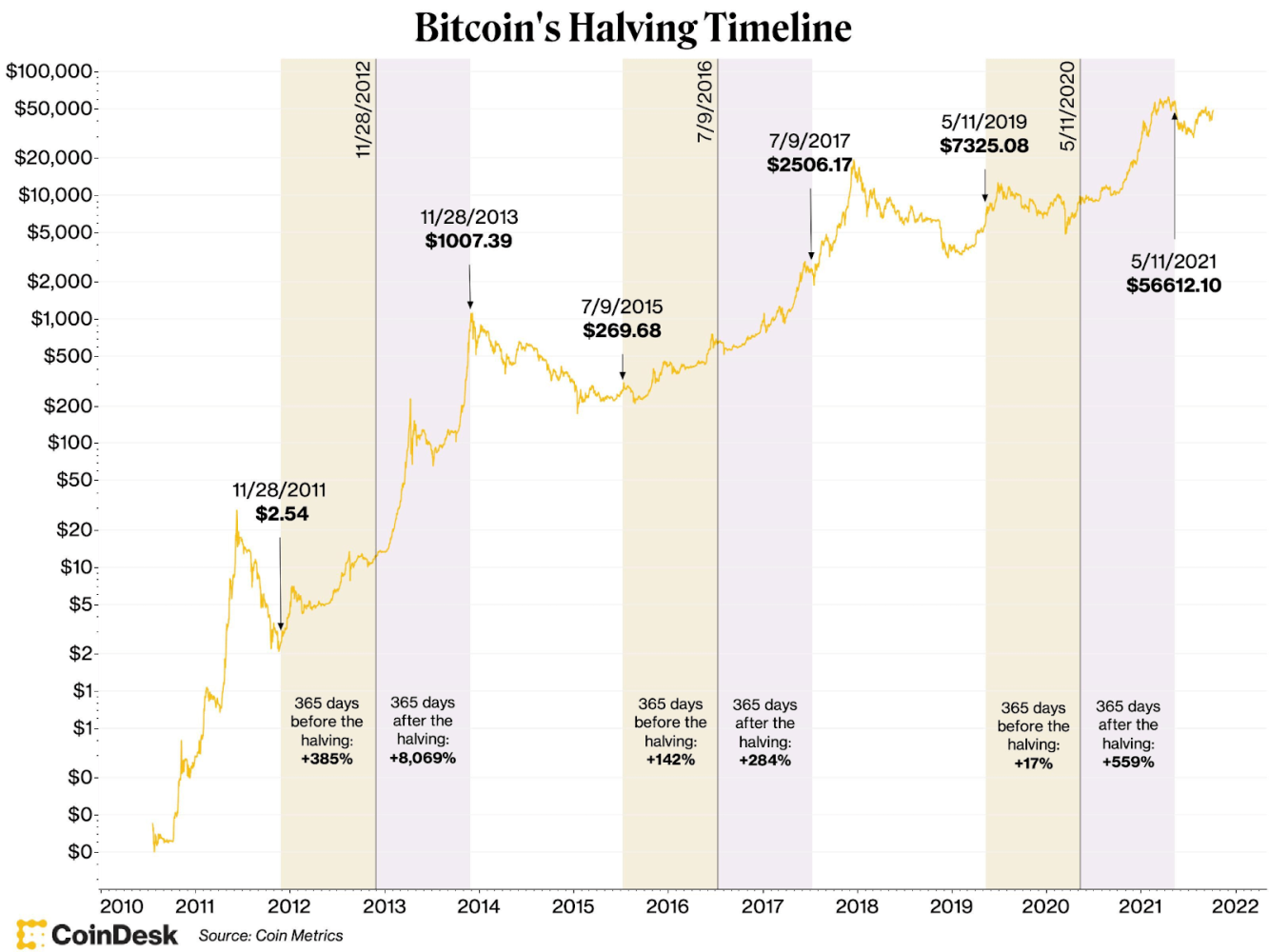

The First Chop: Nov 28th, 2012

BTC Price: $12.20

The first halving slashed the Bitcoin mining reward by 50% from 50 to 25 Bitcoins per block, amounting to 3600 coins daily.

The community was watching anxiously, as the closing price on the halving day was ($12.20). The impact of the halving was still not priced in, months after the first halving in 2012, but the network hash rate and difficulty declined as less profitable miners turned off machines to reduce costs. On the halving day, BTC traded sideways but later soared from $12 to $1166, marking the beginning of its first major bull run—a staggering 9500% surge in just 380 days.

This largely dispelled fears of miner capitulations. The network continued to operate smoothly, teaching the Bitcoin community an early lesson: Halvings are bullish for the Bitcoin network and the price of bitcoin.

Shooting for the Moon: July 9th, 2016

BTC Price: $640.56

The second halving reduced the block reward by another 50% from 25 to 12.5 BTC or 1800 coins per day. The community anticipated another bull run driven by the halving, as the memories of 2012 were still fresh. The community was bracing for another bull run due to the halving, with the 2012 experience still on everyone’s mind. While optimism ran high for a price surge, some voiced concerns that a smaller mining reward could cut into profits and pose risks to the network. And, as events unfolded, history had its own plans.

BTC remained steady on the halving day but saw a -29% decline a few days later, followed by a rapid bounce back. This was followed by a surge from $470 to $19,600, a whopping 4100% rise in only 500 days.

2017 witnessed an extraordinary bull run for bitcoin, marking the first time cryptocurrencies captured global headlines. This laid the groundwork for an even grander bull run four years into the future.

One More Step: May 11th, 2020

BTC Price: $8,605

Bitcoin seemed poised for another bull run. Speculation was rife about increasing institutional adoption and Bitcoin as a hedge against inflation. As scheduled, the mining reward was halved to 6.25 BTC per block or 900 coins per day.

In 2020, BTC experienced a minor -17% dip just days before the halving, followed by several months of sideways price movement. The price surged from $8,700 to $69,000 in a mere 547 days. The bitcoin community was ready, having learned from past experiences. While the halving day was eagerly awaited, the true celebrations kicked off with the remarkable bull run in 2021. Many are now anticipating a repeat of history in 2024.

2024 and the Halving After

BTC Price: $25,764 (Sept 7th, 2023)

As set in stone, this next halving will reduce the mining reward again to o 3.125 BTC per block or 450 coins per day. We are barely a few days from the halving and this is the first time the price of bitcoin has hit a new ATH before the halving and is currently consolidating near the ATH with one of the highest monthly close ever.

The Bitcoin community is eagerly anticipating this milestone. It will make Bitcoin’s supply even scarcer and, hopefully, introduce a new bull market.

Bitcoin’s built-in halvings set it apart, offering predictable control over its supply issuance. While other cryptocurrencies have sought to emulate its model, none have matched Bitcoin’s success with halvings and reducing inflation.

Economic Implications to Miners

Due to the pre-ordained Bitcoin halving, margins for miners will be cut overnight by 50%. While this looks good for traders, hodlers and the overall Bitcoin ecosystem, it doesn’t fair well for miners. Some miners in anticipation of the halving have reinvested for scale, some will go out of business while others have repurposed their mining rigs for training Artificial Intelligence models called Large language models.

Bitcoin Halving forces miners to adopt faster and more efficient mining rigs and cheaper sources of power for mining Bitcoin, this is an arms race to survival and profitability. This has seen Bitcoin mining companies seeking renewable energy sources and setting up shop in African countries such as Ethiopia.

Even though the Bitcoin Halving is likely to lead to a significant short-term drop in miners’ revenues, putting pressure on their profit margins. Weaker, less-prepared miners may not survive this period. However, well-positioned miners could continue to operate and might seize the opportunity to expand by acquiring struggling mining companies or facilities.

Impact on Investors and the Global Economy

The upcoming halving is a tipping point for Investors and the global economy, It’s been established that bitcoin is a more dependable and accepted store of value, independent of central authority. Being the best-performing asset class for over a decade, the adoption of bitcoin as a second national currency by El Salvador, its usage in authoritarian regimes to avoid sanctions, usage in international trade and remittance, and the various ETFs issued by the world’s largest asset managers such as Blackrock and Vanguard, among others.

This further emphasizes that Bitcoin is here to stay and will increasingly become a fundamental component of the global financial infrastructure.

Beyond Bitcoin Halving

There is a setting reality after the upcoming bitcoin halving and it is a groundwork for what will lay the foundation for the next adoption cycle of bitcoin across the world. Some key things to note but not limited to are:

1. Institutional Adoption: Traditional financial institutions and corporations are increasingly adopting cryptocurrencies, leading to greater mainstream acceptance and integration.

2. Regulatory Frameworks: Governments and regulatory bodies worldwide are developing and implementing clearer regulations for cryptocurrencies, which could provide more certainty for investors and businesses.

3. Advanced Technology: Continued advancements in blockchain technology are leading to faster, more scalable, and more secure blockchain networks, opening up new use cases beyond cryptocurrencies.

4. Decentralized Finance-DeFi: The rapid growth of the DeFi ecosystem is offering decentralized alternatives to traditional financial services like lending, borrowing, and trading, with increased adoption and integration.

5. Central banks globally are exploring or implementing their digital currencies (CBDCs), potentially reshaping the broader cryptocurrency market and the global financial system.

Conclusion

Certainly, some critics argue that halvings are unnecessary and that Bitcoin’s supply could have been capped at 21 million with all units released at once. However, Satoshi wisely understood the value of gradual, rule-based issuance in fostering adoption and fairness. Without halvings, Bitcoin wouldn’t have reached its current stature.

Halvings serve as the bridge for each generation of Bitcoin users. Those who were part of the 2012 halving have witnessed the community’s growth and the achievement of new milestones. Meanwhile, those who joined after 2020 look to earlier halvings to understand Bitcoin’s origins. Halvings serve as a reminder of our progress and the journey that lies ahead.

Credit: This article was first published on Convexity Scoops, a publication of Convexity. If you need dedicated expert insight on how to leverage bitcoin and its technology, the Convexity team is available to guide you. Reach out: info@withconvexity.com

Discover more from Crypto Asset Buyer

Subscribe to get the latest posts sent to your email.