Decentralized exchange (DEX) platforms have continued to record significant adoption although the usage of centralized exchanges (CEXs) is still on the high side. Particularly, a recent study carried out by Bybit showed that the 30-day trading volume growth rate across various CEXs —between October 2023 and March 2024 —failed to overtake the growth rate of DEXs.

CEX spot trading volumes jump 3x in six months.

Spot trading volumes on centralized exchanges (CEXs) jump 3x in 6 months. But decentralized exchanges (DEXs) outperform CEXs in 30-day spot trading. Who are the movers and shakers in this exchange market, and what is driving the growth in trading volume?

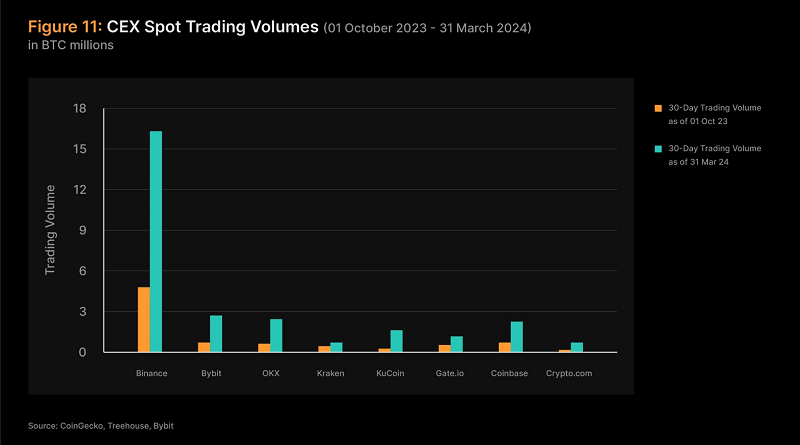

According to the Bybit Institutional Report 20, the monthly spot trading volume on top CEXs increased exponentially in March 2024 from their October 2023 levels. Among the leading CEXs whose 30-day spot trading volume rose substantially within this six-month interval are Binance, Bybit, OKX, Coinbase, Kucoin, Gate.io, Kraken and Crypto.com amongst others.

Data from the report showed that the OKX exchange recorded the highest growth, with its 30-day trading volume increasing by over 278% within the period in consideration. While Bybit recorded a volume growth of over 264%, Binance and Coinbase saw their spot volumes rise by over 239% and 193%, respectively within the period observed.

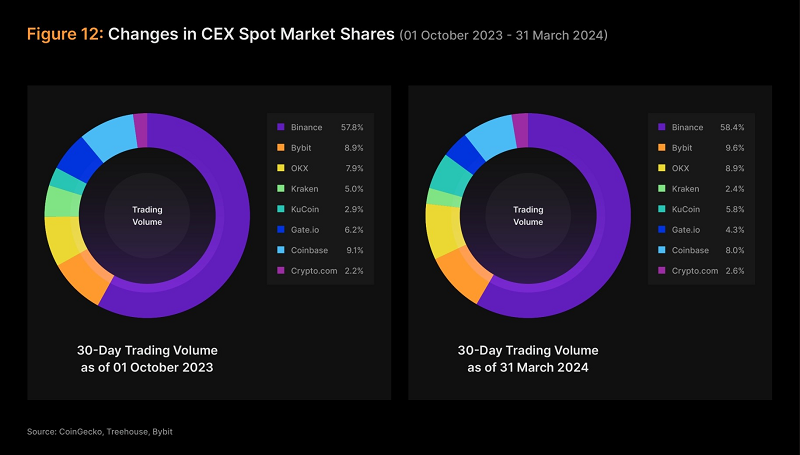

But in terms of overall market share, Binance has continued to dominate the crypto market, followed by Bybit and OKX. As of 31 March 2024, Binance accounted for 58.4% of the total CEX spot trading volume. While Bybit’s market share was about 9.6%, OKX had a market share of 8.9% at that time. Coinbase and Kucoin followed closely with their market shares sitting at 8% and 5.8%, respectively. The report further showed that the crypto market shares of Gate.io, Kraken and Crypto.com were below 5% as of 2024 Q1 end.

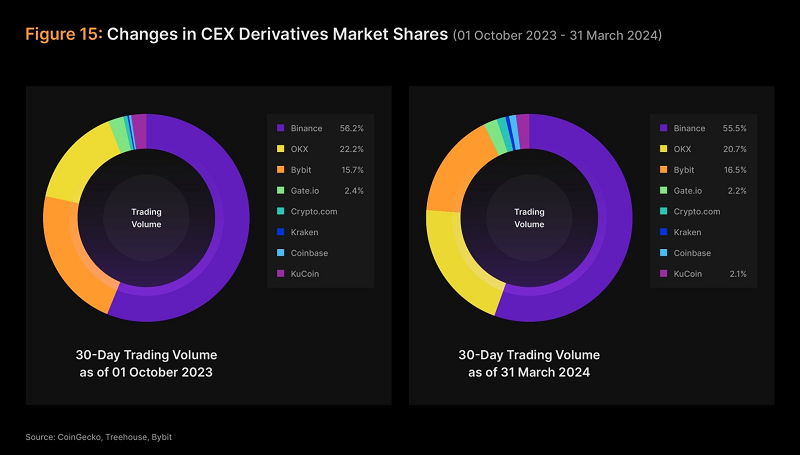

Regarding the derivatives market on CEX, Binance still dominated its counterparts. The leading exchange saw an increase in its 30-day trading volume with growth of about 66.08% between October 2023 and March 2024. Followed by OKX, the first runner-up in this category experienced a slight growth in its derivatives trading volume, boasting an increase of 57.34%.

“These growth trends were largely propelled by the significant price movements in BTC and ETH, along with the ETF approvals, which injected liquidity into the cryptocurrency market and attracted new participants to major centralized exchanges,” the report said.

Related: What are the top 5 centralized crypto exchanges you should know?

DEXs outperform CEXs in 30-day spot trading volumes.

Looking at the 30-day trading volume across various decentralized exchanges (DEXs), Pancakeswap AMM v3 came top, followed by Uniswap v3, Orca, and Raydium accordingly.

According to the report, Pancakeswap v3 recorded a significant 580% increase in trading volume, from $3.43 billion in October 2023 to $23.49 billion in March 2024. The Ethereum-based DEX Uniswap v3 also had an impressive growth of over 320%, increasing $17.19 billion in October 2023 to $65.50 billion in March 2024.

Solana-based platforms Orca and Raydium were among the DEXs to record significant volume growth within the observed period, following the recent memecoin and airdrop mania.

Related: What is really behind Solana’s emergence as the leading blockchain ecosystem in 2024?

Uniswap leads in DEX market share; Pancakeswap follows.

Uniswap v3 has continued to dominate the DEX ecosystem in terms of market share. Notably, Uniswap v3 commanded 48.9% of the DEX market share in October 2023 with Pancakeswap v3 accounting for only 10%. But as of March 2024, the market share of Uniswap v3 dropped slightly to 33%, while that of Pancakeswap v3 rose minutely to 11.8%.

Similarly, Uniswap v2 share of the overall DEX market clocked 5.8% in March 2024, up 0.4% from its market share of 5.4% in October 2023. The recent memecoin season led to Orca and Raydium commanding 11.4% and 8.2% of the total DEX market share. Other DEXs with significant market shares include Curve DEX (5.6%), Thorchain (5.4%), Phoenix (4.7%) and Lifinity V1 (4.5%).

Conclusion

It’s interesting to see DEXs —such as Uniswap v3 and Pancakeswap V3— overtake leading CEXs regarding their 30-day spot volume increases within the observed period. The development reflects the heightening interest in decentralized finance (DeFi) and the adoption of DEXs amid the ongoing regulatory troubles encountered by several CEXs.

Overall, the increase in trading volume among DEXs and CEXs can be attributed to rising market liquidity, fueled by several factors. These factors include the approval of some spot bitcoin ETFs in the U.S. and Hong Kong, BTC reaching an all-time high above $73,000 and the successful fourth bitcoin halving amongst others.

Read also: Top 5 Decentralized Crypto Exchanges You Should Know

Credit: Ndianabasi Tom A crypto journalist and content writer who has been talking about cryptocurrency and blockchain technology since 2018, Ndianabasi is a Writer at Crypto Asset Buyer (CAB).

Discover more from Crypto Asset Buyer

Subscribe to get the latest posts sent to your email.